BLUE BANANA

BLUE BANANA

BLUE BANANA

BLUE BANANA

Shared Ownership refers to a concept where more than one party owns an interest in an insurance policy. Â The most common of these arrangements is where the corporation is the owner and beneficiary of the death benefit and the shareholder or employee owns the cash value of the policy. Â

Recently there has been growing interest in applying this strategy to a Critical Illness policy. Â Although the CI policy does not have cash value, there is usually an option to have a Return of premium (ROP) in the following situations:

-

Upon death – If the insured dies without having submitted a claim for critical illness the premiums paid are refunded;

-

Upon Termination – If the policy reaches its termination age without a claim being made, the premiums paid are refunded;

-

Upon Surrender – If the policy is surrendered without a claim, premiums paid are refunded.

Who should consider this arrangement?

Anyone who owns shares in a corporation and wishes to protect that corporation against loss if one of the shareholders or other key employee is diagnosed with a critical illness.

How does it work?

A Shared Ownership Agreement is drafted documenting:

-

That the corporation will own, pay for and be the beneficiary of the CI coverage on the key shareholder or employee;

-

That the shareholder will own and pay for the Return of Premium option upon the surrender of the policy.

Who benefits?

Under this arrangement the company is protected against loss but should no critical illness occur the shareholder/employee will receive a financial benefit as the premiums paid will be refunded.

Is this really an important planning strategy?

Â

Â

Consider this*,

-

One in three Canadians will develop life threatening cancer;

-

Half of all heart attack victims are under the age of 65;

-

Each year 50,000 Canadians suffer a stroke with 75% of all victims being left with a disability.

The CI Shared Ownership Strategy can result in significant financial benefits for the individual shareholder while the Corporation enjoys the protection of its key employees against loss from a critical illness.

Call me if you would like to explore whether this strategy will benefit you and your company. Â Or feel free to use the sharing icons below to forward this to someone who might find this of interest.

For Barry’s case study, Industrial Alliance’s Transition Critical Illness product to age 100 with Flexible Return of Premium was illustrated. Of course, results will depend on age and amount plus product features will be vary by company.

*Source: RBC Insurance

Pay Attention to Your Beneficiary Designation - It’s More Important Than You Think

Naming a beneficiary is a valuable feature of life insurance and segregated funds policies so it is important to carefully choose your beneficiaries.

Estate – the default choice

Many people choose to name their “estate†as their beneficiary.  Although this is an easy short-term solution, it is important to review the risks of doing this.  If you are stuck for a significant “other†beneficiary, don’t forget to change it to a more appropriate option later.  Why?

-

The proceeds will be subjected to probate fees and the benefits received will be co-mingled with all the other estate assets which may be exposed to various third parties.Â

Â

What’s in a name?

Simply naming an individual or trust as beneficiary will keep the proceeds out of the insured’s estate and also protect the death benefit from the claims of creditors or litigants.

Â

VIP Beneficiary

A “preferred beneficiary†is a spouse, parent, child or grandchild and receives VIP treatment in the form of protection.  All the proceeds of the life insurance product (including Segregated Funds) are protected against claims of the creditors or litigants of the life insured not only upon his or her death, but any cash values in that policy are also protected during the lifetime of the insured.Â

-

A minor “preferred beneficiary†will require a trustee for their portion until they reach the age of majority.

-

Note that the preferred beneficiary status does not apply to siblings.

Trust your trustee

Think carefully about to whom you assign the task of trustee. Â It can be a difficult role to fill, often challenged by trying relationships. Be sure to discuss the role with your intended trustee and make sure they are comfortable with it and understand the responsibilities of the role.

Contingency Plan

Often parents of minor children are concerned about would happen should they both tragically pass away at the same time. For this reason, the children are often named as “contingent beneficiariesâ€.  If the children are minors, the trustee named to act on their behalf, will receive the proceeds directly upon the death of their parents avoiding any estate considerations.

As life changes, so do beneficiaries

If you have an older life insurance policy it is probably a good idea to review the named beneficiary as your circumstances may have changed.Â

It may be time for a change if……

-

You have divorced - If you have a divorce agreement that required you to maintain your spouse as the beneficiary, have the conditions of that requirement now expired (e.g. children are now of age) and is no longer required?

-

If you have remarried - is your ex-spouse still named as the beneficiary?

-

If a policy was assigned to the bank or other lending institution – have the assignment removed if the loan is paid off.

-

If you have new dependents - children, grandchildren or even dependent parents. Â

-

If your children are now grown up - and have families of their own, does this change how you want your life insurance proceeds to be paid?

-

If your children are married, their spouses may have access to these proceeds too. Is their relationship solid, or is their a risk of half of your life insurance proceeds being paid out as part of a divorce settlement? Perhaps you should consider naming your grandchildren as beneficiaries instead?Â

Â

The need for life insurance no longer exists

Often, older individuals find they have no one to whom they wish to leave their insurance proceeds. Â In this situation, naming a registered charity will provide a charitable tax deduction in the full amount of the proceeds at death.

Let’s review your beneficiary designations and make sure your life insurance proceeds end up where you want them to be.  As always, feel free to use the sharing icons below to forward this article to someone who might find it of interest.Â

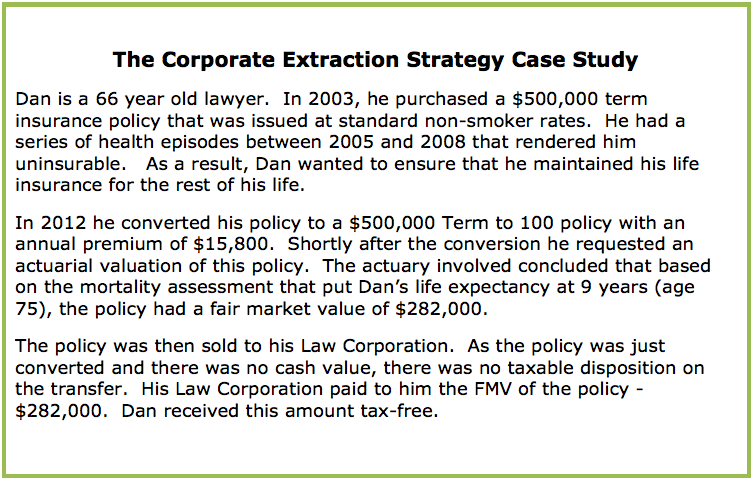

The Corporate Extraction Strategy

Transferring a Life Insurance Policy to a Corporation

The Corporate Extraction Strategy involves transferring a personally owned life insurance policy to a corporation for its fair market value (FMV). Â When handled properly, it could result in withdrawing capital from the corporation tax free!

The preferred candidates for this strategy

-

Own a life insurance policy that they wish to maintain;

-

Own all the shares in a corporation;

-

Are usually older and/or would be rated or declined for life insurance due to health concerns.

The life insurance policies best suited for this strategy

-

Term insurance policies with an option to convert to permanent insurance;

-

Permanent policies with or without cash value where the Adjusted Cost Base (ACB) exceeds the Cash Surrender Value (CSV).

There are two separate transactions with income tax implications

-

The shareholder transfers his or her policy to the corporation. Â This will result in a disposition of the policy and the excess of cash value over the ACB will create taxable income. Â Where the policy has no cash value or cash value that is less than the ACB, no tax will result. The company receives the policy with its ACB set equal to the Cash Surrender Value on date of transfer.

-

The company may pay any amount for the policy to the shareholder up to the FMV of the insurance. Â If the FMV is higher than the CSV, the proceeds of the transfer are received by the shareholder tax free.

Establishing the Fair Market Value of the policy

This will require the services of an actuary to provide a proper valuation of the insurance contract. Â Also required will be a projected age of mortality most commonly provided by a life insurance underwriter. Â The actuary will consider all factors relevant to the appraisal and provide a report indicating the FMV of the policy. Â This report will be used to justify the payment to the shareholder. Â Under ideal situations, this payment is often substantial.

Factors to consider

-

Since the life insurance will be now owned by and payable to the corporation, proceeds at death will no longer be creditor proof as the corporation is not a preferred beneficiary;

-

Changing the policy back to personal ownership at a later date, could have adverse tax consequences;

-

Even though the proceeds at death are payable to the corporation, those proceeds can still be received tax free by your heirs via the Capital Dividend Account.

Uses of life insurance in the corporation

It is always advisable to have a business reason other than just the tax results in any strategy involving life insurance. Â Below are some of the more common reasons for corporate owned life insurance:

-

Key person coverage;

-

Stock redemption or buy/sell coverage;

-

Paying insurance premiums in a low tax rate (small business rate) environment;

-

Corporate tax shelter – transferring highly taxed corporate investments into the tax deferred cash value account of a life insurance policy;

-

Capital Dividend Account planning.

What does the Canada Revenue Agency say?

The CRA has acknowledged this strategy and refers to the tax result achieved as an anomaly under the Income Tax Act.  In 2003 they stated, “The result of this transaction is that the shareholder is effectively receiving a distribution from the corporation on a tax-free basis.  We previously brought this situation to the attention of the Department of Finance and have been advised that it will be given consideration in the course of their review of policyholder taxationâ€.  These comments were echoed again in 2009. Â

The recent changes to the Income Tax Act introduced in 2013 were silent on this issue so the strategy remains viable. Â Given the CRA comments, however, we expect the door to close on this planning opportunity in the near future.

The window of opportunity may close on this at any time, so don’t delay if you think this is appropriate for you. Â

Call me if you think want to explore this strategy further. Â Or please feel free to use the sharing links below to forward this to someone who might find this of interest.