Are you a small retailer in a cold sweat about showrooming? This trend where customers browse in-store but then buy products online, began striking fear into retailers’ hearts a few years ago.

Who wants customers coming in, trying on or feeling the products you offer, and then buying them at a deep discount from Amazon or some other site?

The trend was especially unsettling for small, independent retailers. While big national chains with huge volume may be able to afford to price-match online sellers, independents are less likely to be able to do so without losing their shirts.

But a new report from Merchant Warehouse suggests that instead of stressing about showrooming, small retailers should welcome “webrooming.â€

What is Webrooming?

The reverse of showrooming, webrooming is when consumers research products online, then come into a physical store to buy them.

Webrooming is even hotter than showrooming – and it’s creating new opportunities for brick-and-mortar retail stores.

What You Need to Know About Webrooming

It’s more popular than showrooming.

Some 75 percent of men and 63 percent of women webroom, compared to 53 percent of men and 40 percent of women who showroom. By other demographic measures, such as age, consumers are also more likely to webroom than to showroom.

What might surprise you is to learn that consumers aged 18 to 36 are equally avid webroomers as those aged 49 to 67. Sixty-nine percent of both groups webroom, but only 50 and 44 percent respectively showroom. And while 90 percent of showroomers have also webroomed, just 60 percent of webroomers have showroomed.

Why Do Consumers Webroom?

Particularly when they could just as easily order a product online – why add that extra step?

- 47 percent don’t want to pay for shipping. To make sure you capture the sale, try offering coupons good only for users who visit your site, then buy a product in-store. Or allow customers to order online and pick up in-store to save on shipping.

- 46 percent want to see and touch a product before buying it. This is especially important with “sensory†products like home furnishings, clothing and cosmetics. Encourage customers to test products in-store, and create displays that are tactile and inviting.

- 42 percent want to check in-store availability online - then go to the store so they don’t waste a trip. Look into an eCommerce system that has this capability for your store, and educate employees about the importance of making sure data is accurately maintained so customers aren’t disappointed.

- 37 percent want to be able to return products to a physical store. You can capture both online and in-store sales to these consumers by offering the ability to buy online and return in-store.

- 23 percent don’t want to wait for delivery. For those impatient consumers, be sure you have in-store availability information on your eCommerce site so they can check it out. Make sure that your clerks have accurate inventory info at hand in case the customers call the store as well.

That’s up to you. Merchant Warehouse suggests doing it during especially competitive times, like the holidays. However, be aware that information spreads rapidly on social media today and if you price match for one person, he or she is likely to tell friends who will then expect the same treatment (and may badmouth you if they don’t get it).

If you do price match, you may want to set limits such as price matching one item per customer or deduct a certain percentage from the price without actually matching. That way, the customer is still getting a deal while also getting the product quickly.

Check out the graphic below for more.

Social media e-commerce has taken off — and it's showing no signs of slowing down. With social media selling, anyone can become an online merchant without having to invest in a website or give online marketplaces a cut of their profits. Here are 10 social media selling solutions to help you get started.

Social media e-commerce has taken off — and it's showing no signs of slowing down. With social media selling, anyone can become an online merchant without having to invest in a website or give online marketplaces a cut of their profits. Here are 10 social media selling solutions to help you get started.1. Soldsie

Want to sell on Facebook? The Soldsie Facebook app turns the social network's comments section into an e-commercepowerhouse. Typically, customers make purchases on Facebook by messaging sellers or leaving their email addresses. Instead, Soldsie's "Comment Selling" system eliminates all the back-and-forth communication by streamlining transactions. To start selling, connect Soldsie to your Facebook page, and upload product photos. These posts become your storefront, where fans can simply comment "Sold" to make a purchase. After commenting, they'll automatically receive an email invoice and proceed to checkout via PayPal or WePay.

2. inSelly

Instagram isn't just a photo-sharing platform; it has also become one of the most popular online selling tools available. inSelly, an Instagram marketplace, facilitates the process by aggregating Instagram listings (using hashtags) and making them searchable to anyone around the world. Because it's a third-party platform, you'll first have to connect the app to your Instagram accounts. Next, add your contact information, pricing details and PayPal email address to start making sales and receiving payments. ['Buy Button' Could Make Twitter Your New Storefront]

3. Hashbag

Hashbag is another Instagram selling tool that provides a centralized place to showcase Instagram listings. Sellers get their own storefronts on the Hashbag marketplace, while buyers search for items using hashtags. To start listing, first Instagram a photo of your product with the hashtag #forsale. You'll automatically receive an email asking you to log in to Hashbag, where you'll be able to set your price. The listing will then go live, and buyers can start making purchases via PayPal.

4. Chirpify

The hashtag is the universal language of social media, making it a powerful social selling tool regardless of the platform. Chirpify, a social commerce platform, takes unique campaign hashtags — referred to as "actiontags" — and uses them to enable purchases across multiple social networks. First, customers see the actiontag on social media, print, television and other marketing channels. Next, all they have to do is post the actiontag on Twitter, Facebook or Instagram to activate a purchase. Chirpify then responds immediately to collect payment and instantly convert sales.

5. Beetailer

Even if you own an e-commerce website, cross-selling products on social media is a great strategy to boost sales. One service that makes this possible is Beetailer, which lets online merchants import their store into Facebook. After the initial migration, the system is basically hands-free — it requires no installation, configuration or maintenance, and products are automatically updated based on the website's inventory data. Included in the service are marketing tools like campaigns and promotions, detailed analytics, and integration with existing checkout systems.

6. Heyo

Designing Facebook page campaigns can seem like rocket science for people who aren't tech savvy. Heyo simplifies the process with a drag-and-drop campaign builder that anyone can use. The service works a lot like do-it-yourself website builders: Start by choosing a template, and then edit or customize elements to fit your campaign and brand. Whether you're running a contest, promotion or special deal, campaigns built on Heyo can then be easily plugged into your Facebook page — no coding necessary.

7. Fanchimp

Automation is key to saving time and money. Fanchimp lets businesses automate Twitter and Facebook selling by enabling them to schedule posts and promotions. Although there are already services that have the same scheduling capabilities (HootSuite, TweetDeck), what makes Fanchimp different is that it connects directly to your online store. Just log in to the system, and you can choose which products to promote, and when to promote them, directly from your inventory. Fanchimp can also set posts to go live at the optimum times and intervals for maximum viewership.

8. Poshmark

Although Twitter, Facebook and Instagram are the most popular social selling platforms, there are niche marketplaces that also function as their own social networks. One such marketplace isPoshmark, a website and mobile app for buying and selling fashion. Like on Instagram, sellers first take a photo of each product and post it to Poshmark with the item and pricing details. Customers can also like listings, as well as leave comments and follow sellers. Unlike Instagram, however, customers can make purchases directly through the service via the Buy button. Poshmark takes care of all the back-end processes, so the only thing sellers have to do is ship the item to get paid.

9. Facebook for Business

Facebook for Business is the one-stop shop for finding out which types of Facebook selling campaigns will work best for your business. The service lets you create Facebook pages and purchase Facebook ads, as well as integrate Facebook into your website or mobile app. Facebook for Business helps merchants create buzz, find new customers and drive sales, using one centralized hub. The service also includes analytics tools that provide key insights and measure campaign performance.

10. Pinterest for Business

There's a saying that consumers don't trust brands; they trust their friends. That's essentially the principle behind Pinterest for Business, which lets businesses create Pinterest accounts as a brand. In addition to pinning items just as regular users can, businesses can add the Pin It button wherever their items appear on the Web. For example, e-commerce website Etsy added the Pin It button to each individual listing — when Pinterest users click on the Pin It button, the corresponding Etsy item will be added to their Pinterest boards for their followers to see. These pins include the seller's shop name and pricing information, so viewers know the item is for sale. The idea is to drive traffic, grow followers and ultimately boost sales based on other Pinterest users' recommendations.

By Sara Angeles, BusinessNewsDaily Staff Writer

Originally published on Business News Daily.

Credit: Social media image via Shutterstock

If A/B Testing Can Help Win Elections, What Can It Do for Your Business?

Tags: Online retailers are always looking to differentiate themselves in more meaningful ways. Compelling shopping experiences, product recommendations, and overall superior customer service are key ways retailers set themselves apart. Today's data-driven marketing tools can help them unlock those experiences by using the data they have about their customers.

Online retailers are always looking to differentiate themselves in more meaningful ways. Compelling shopping experiences, product recommendations, and overall superior customer service are key ways retailers set themselves apart. Today's data-driven marketing tools can help them unlock those experiences by using the data they have about their customers.Prior to founding my own company, I served as the director of analytics on the 2008 Obama campaign. By experimenting with changes to elements of the campaign splash page, we were able to help raise an additional $57 million in campaign donations.

The guiding principles that made the campaign successful are no different from approaches online retailers and other marketers can adopt to make a real business impact.

First, you need to know your constituent. The behavior of visitors who come to your website is very much indicative of the kind of messaging that would work on them. What you show a returning visitor is different from what you'd show to a new visitor, or a mobile visitor vs. a desktop visitor.

The urgency for businesses to use data to show the right thing, to the right person, at the right time is stronger than ever. Targeted messaging is the most to effective way to get consumers to convert.

Second, you must know the facts. One of the greatest challenges (and areas for error) for businesses is getting the data right. Online retailers should take prudent effort to make sure the infrastructure and process they've implemented is sound. For example, the "novelty effect" suggests that just because a change has an impact initially doesn't mean it can be sustained over time. Will your customers grow tired of cyber deals every 10 minutes for a week?

Finally, it's imperative to ask the right questions. The challenge for online retailers is not about prescribing the right answers but about asking the right questions. For instance, are you trying to see whether a visitor will respond better to more product selections on a page, or fewer? Consider first what you want the answers to be, and those hypotheses will then help you decide what to measure.

Common examples of A/B testing for online retail include homepage bounce rates, category-page views, product-page views, shopping cart ads, and all stages in a checkout flow all the way to the Thank You page.

In general, to get more effective and relevant results, rather than asking "What are the variations we are testing?" consider asking "What question are we trying to answer?" To ensure the best return on your effort, first look at your Web analytics to see which pages have the most room for improvement. You'll want to attack those areas first.

The following are some actionable insights to help retailers optimize their sales by running website experiments that help them deliver a better experience to their visitors.

Homepage. The homepage is notoriously the most over-scrutinized page, yet it is also likely to be the most under optimized. For instance, imagine you're a consumer shopping on a retailer's website for a new coat. You arrive on the homepage and see a banner for a sale. Just as you're about to click it, the experience changes to pants. The rotating carousel of images means you have to continually reorient yourself, and it diffuses the focus of your original purpose. And when consumers are distracted, they're probably not purchasing.

Category pages. Unfortunately, most retailers tend to overlook their category pages; luckily, there are some easy and effective tests to evaluate them. One simple experiment centers on the performance of tiled vs. list views. For example, in our experience, the list views perform better and lift sales for scenarios in which consumers are making a complex purchase decision. The list format enables consumers to scan information easily and compare between categories; it also gives the retailer space to display the best sellers above the fold.

Product detail pages. Where does the consumer ultimately decide whether to buy or bounce? The product detail page is where the final persuasion happens. Therefore, it is one of the most important areas of your website.

Often, retailers are looking for a solution to a distinct challenge: solid brand awareness, but poor conversion. In that scenario, it's difficult for the retailer to determine what to improve. To increase conversion, I recommend carefully examining the following key conversion factors in the product detail pages:

- Value proposition:Â Is it strong or weak?

- Relevance:Â Is the content pertinent to the target audience and their needs?

- Clarity:Â How clear is the imagery, eye flow, copywriting, and call to action?

- Distraction:Â Are you redirecting attention from the primary message with too many product options? Are upsell and cross-sell options provided prematurely? Are design elements overwhelming the message?

- Urgency:Â Are you giving the consumer a reason to act now?

For example, knowing that users become more invested as they click through the signup funnel, the 1-800-DENTIST team hypothesized that making the first step as simple as possible would decrease drop off rate and lead to more successful signups further down the funnel. To test the hypothesis, the team considered how to best simplify the first step without losing valuable data collection. Since all dentist matches depend on location, ZIP code was the most logical input to lead off with. Then, the team moved the two other fields—insurance and dental need—to pages later in the funnel, ensuring they would still be able to collect each piece of information. In less than a week, the team found that shortening the first step of the checkout funnel increased conversions 23.3%.

* * *

The greatest opportunity for online retailers today lies in facilitating the process of experimentation to help their teams move from the era of Mad Men into the era of Math Men. The role of creativity is still as important as it's always been, but now it's not centered on the most intuitively creative person but, rather, the most data-driven creative person.

We live in a time where you can let the data help you get to the right answers. You'll quickly find that the tests take the guesswork out of website optimization and enable data-backed decisions that shift business conversations from "we think" to "we know."

And knowing your website's weaknesses means that you can turn them into strengths and sales.

by Dan Siroker

Engineering students invent virtual fitting room for online shoppers (w/video)

Tags: Rice University engineering students Cecilia Zhang, left, and Lam Yuk Wong, have created a virtual fitting room for online shoppers. Their program, which uses Microsoft’s Kinect motion-capture device, turns users into virtual mannequins to make online garment fitting more accurate.

Rice University engineering students Cecilia Zhang, left, and Lam Yuk Wong, have created a virtual fitting room for online shoppers. Their program, which uses Microsoft’s Kinect motion-capture device, turns users into virtual mannequins to make online garment fitting more accurate.One blessing of the Internet: shopping conveniently online for clothes. One curse of the Internet: shopping conveniently online for clothes.

"Nothing fits," said Lam Yuk Wong, a senior in electrical and computer engineering at Rice University. "Everybody says this. They order clothes and they don't fit. People get very unhappy."

Wong and her design partner, Xuaner "Cecilia" Zhang, are Team White Mirror, creators of what they call a "virtual fitting room." Their goal is simple and consumer-friendly: to assure online clothing shoppers a perfect fit and a perfect look with every purchase.

Both women are from China, Wong from Hong Kong, Zhang from Beijing. Both order most of their clothing online. They got the idea from their own experience as consumers and from listening to the complaints of friends and relatives.

"They say, 'The color is wrong' or 'I got the right size but it does not fit right.' We want to make it like you're in the store trying on the clothes," Zhang said.

Using a Kinect, the motion-sensing input device developed by Microsoft for use with its Xbox 360Â video game player, Zhang scans Wong and turns her image into, in effect, a virtual mannequin, preserving Wong's dimensions, and even her skin and hair color.

With the software developed by the students, shoppers are able to see realistic details, even wrinkles in the garments. They can rotate the model to see how the garment fits from all sides. Thus far, Wong and Zhang have adapted the software to show dresses and shirts, and they are working on shorts.

Their paper, "Virtual Fitting: Real-Time Garment Simulation," will be presented at the 27th annual conference of Computer Animation and Social Agents to be held May 26-28 at the University of Houston. The team received further validation when it won the $5,000 Willy Revolution Award at Rice's annual Design Showcase April 17.

Asked if she thought men as well as women might be interested in using their virtual fitting room, Wong said, "I think their wives will care about this, so it will also be important to the men."

(Phys.org) Credit: Jeff Fitlow/Rice University

Consumers are bored with the online shopping experience and want something new. But online and pick-up-in-store options are no longer a novelty for consumers. They want more.

Consumers are bored with the online shopping experience and want something new. But online and pick-up-in-store options are no longer a novelty for consumers. They want more.Budgets are shifting to improve the experience of Web sites and ecommerce systems. Management and delivery tools continue to gain traction with brands, because many want to improve their customers' digital experience before the major year-end holidays. A Forrester Research study reveals that 45% will focus on content management, 26% on ecommerce platforms, 23% on digital asset management, and 21% on testing and optimization 21%. The study surveyed 148 digital customer experience professionals about their strategies for the next 12 to 24 months.

On-site search requires an even better experience than traditional engines like Bing, Google and Yahoo. If there's any doubt that consumers are fed up with the experience, the white paper, Your Site Experience Is Old School, from Compare Metrics tells all. It analyzes site navigation tools and online shopping experiences in an effort to explore how to double the average order size of Web purchases and highlight opportunities for retailers. The basis for the paper comes from a study done with the eTailing group earlier this year.

"Consumers prefer to browse vs. search," said Garrett Eastham, CEO of Compare Metrics, making the distinction of looking through the merchandise and action of discovery vs. the tactical act of typing in a keyword looking for something specific. "The more relevant the inventory the more likely consumers are to engage and make a purchase."

The white paper reveals that shoppers often go online for inspiration. They believe it's more efficient searching through the Web site than racks and shelves in the physical store. This gives them an opportunity to make a purchase as well as to find design ideas.

In fact, 67% of consumers go online to browse and window shop for fun. Some 90% of shoppers spend the majority of their time shopping online when they know exactly what they want. When it comes to discovery and navigation of Web sites, consumers gave the experience five out of 10 points.

Some 73% of consumers said Web site category filters eliminate products that consumers wanted to see. Shoppers are also becoming less tolerant with inefficiencies in on-site search. Some 4 out of 10 consumers don't trust it, and 64% said they would rather have simplicity in the search process.

The white paper suggests increasing the sites' "wow factor" by focusing on commerce-driven content, as compared with pure editorial content, available naturally on the site rather than outside, the shopper's chosen discovery path. Make it easier to find products. Some sites are two complicated, have too many options and load slowly. Most of all, don't limit products or only show best picks. This will alienate those with a different taste in product. Consumers will close the browser and go on to the next retailer with an easier ecommerce system.

By Laurie Sullivan, writer and editor for MediaPost

As competition intensifies, coming in all new shapes and sizes, global e-commerce organizations face challenges in differentiating their offerings with key audiences. To succeed, marketers cannot afford to miss opportunities to improve the effectiveness, reach, and return of their marketing and sales programs. Yet, a recent survey we conducted with 160 global retailers found the majority are missing out on significant opportunities to use tools that already exist in their arsenal to improve theROI of marketing campaigns.

According to the survey, online retailers are prioritizing their e-commerce platform, site search, and SEO, as well as mobile and customer-focused analytics. Still, nearly 60% admitted to not using site search reports and information to enhance marketing programs, and only 25% say they integrate site search data into email marketing campaigns to better customize offers for customers—implying there is still a great deal of value organizations can pursue, from integrating site search information to integrating their marketing campaigns.

Interestingly, half of the survey respondents said they are not doing more with site search to enhance marketing and sales programs due to limited resources, while nearly 30% say they just aren't sure how to do it and 10% note that their existing site search solution does not allow for integration with marketing programs.

Savvy online retailers reap rich benefits from site search

Every retailer knows site search is a must-have element of any online business—yet it's clear they're not taking full advantage of the rich benefits site search can provide to marketing and sales strategies. With the right approach, online retail marketers can glean valuable insights into visitor habits and buying behavior to help them deliver a richer user experience—which, in turn, can encourage a purchase.

Take, for example, gourmet candy maker Jelly Belly, which uses site search data to ensure that the appropriate top-searched keywords are incorporated into press releases, advertising, and marketing materials. Jelly Belly also uses site search merchandising capabilities to tune results and create landing pages for customized product groupings.

For a previous Cinco de Mayo promotion, Jelly Belly grouped various beans together to create “recipes†for tres leches cake and Mexican hot chocolate. The company then used the URLs of those dedicated landing pages for display advertising, retargeting, and email campaigns. Jelly Belly also dropped a banner tool onto the page to tie the promotional assets from the email or banner ad to the landing page. The result was an 85% increase in open rates for direct mail campaigns.

Site search improves decision making

You don't have to be a master at harnessing a large amount of data in order to make the important information work for you. Data gleaned from site search can be incredibly helpful in the decision making process.

According to our poll, half of retailers currently use site search data and analytics to enhance their business offerings or processes, while 28% use site search data to make smarter decisions related to inventory selection, 26% use site search data to enhance customer service, and 18% use it to augment predictive analytics practices.

The majority of retailers say they have not implemented site search features such as auto-complete with graphics (55%), mouse-over pop-ups (59%), personalized search history (64%), refinements (43%), or a floating search bar (80%). Most merely rely on site search features they have already, such as auto-complete (62%) and refinements (43%) to do the job—a significant miss for these retailers.

The good news is, nearly half (47%) of retailers plan to change their ways, and will work to incorporate more features, functionality, and data gleaned from site search to enhance marketing programs throughout 2014. As they do, there will be more effective ways to propagate information to their consumers, suppliers, and alliance partners that will lead to better online shopping experiences, brand-building opportunities, and revenue generation.

Tim Callan is the CMO of SLI Systems.

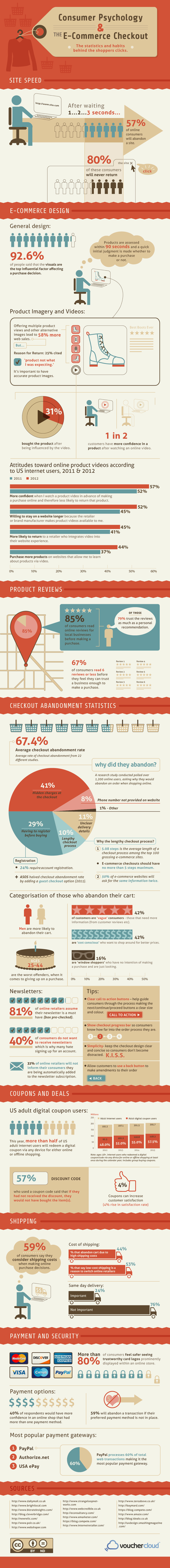

Consumer Psychology and The Ecommerce Checkout-Stats Behind the Clicks [Infographic]

Tags:What’s the secret to a successful E-commerce site? Is it graphics; ease of use; loading time. or something else, something harder to define?

As anyone who has ever attempted to find their place within the saturated E-commerce market will know, while traffic levels are indeed part of the battle to succeed; it is in fact a whole new challenge to convert that traffic into sales. Your products might be unique, crafted with quality and have an attractive price point for consumers; but it could be your website that lets your brand down leading, to lost sales.

Vouchercloud has collated the latest statistics and data within this new infographic demonstrating how consumers respond to various features within the checkout process and how they can lead to cart abandonment and lost sales.

Infografic Source:Â Vouchercloud

Tweet These Stats

- 57% of online shoppers will abandon a site after waiting 3s for page load, 80% won’t return Tweet this

- 92.6% of online shoppers say visuals are the top influential factor affecting a purchase decision Tweet this

- Offering multiple product views and alternate images leads to 58% more web sales Tweet this

- 57% of online shoppers have more confidence in purchasing a product after viewing product video Tweet this

- 52% of online shoppers say they are willing to stay longer on sites that use product videoTweet this

- 45% of online shoppers are more likely to return to a retailer who integrates video into the website experience Tweet this

- 85% of consumers read online reviews for local business before purchase, 79% trust them as much as a personal recommendation Tweet this

- 41% of online shoppers will abandon a checkout due to “sticker shockâ€Â Tweet this

- 29% of online shoppers will abandon checkout if asked to register (24% of ecommerce sites require reg)Â Tweet this

- Only 10% of online shoppers will abandon a checkout process they perceive as “too longâ€Tweet this

- 50% of ecommerce checkouts ask for the same information twice Tweet this

- 81% of online retailers pre-check newsletter opt-ins in registration (40% of consumers don’t want them) Tweet this

- 59% of consumers consider shipping costs when making online purchase decisions Tweet this

- More than 80% of consumers feel safer seeing logos of trustworthy payment options on a site Tweet this

- 40% of online shoppers say they have more confidence with sites that offer >1 payment option Tweet this

Biggest Digital Marketing Takeaways From Comscores State Of The US Online Retail Economy, Q3 2013

Tags:

Last year’s U.S. eCommerce holiday spending season fell slightly short of initial forecasts, but continued to grow 14 percent over 2011. comScore presented its “State of the U.S. Online Retail Economy, Q3 2013†(SOR13) webinar, which offered some exciting 2013 holiday spending forecasts for retailers as well as insights into opportunities for digital marketing strategy this year and beyond.

Last year’s U.S. eCommerce holiday spending season fell slightly short of initial forecasts, but continued to grow 14 percent over 2011. comScore presented its “State of the U.S. Online Retail Economy, Q3 2013†(SOR13) webinar, which offered some exciting 2013 holiday spending forecasts for retailers as well as insights into opportunities for digital marketing strategy this year and beyond.

This year’s holiday season is the shortest it has been since 2002, with approximately 6 fewer days of shopping than last year. However, concerns over unemployment and rising consumer prices have lessened, laying the groundwork for an exceptionally promising Q4 2013. When comparing Q3 2013 to Q3 2012, for example, total dollar sales are up 13 percent to $47.5 billion. Additionally, total dollars spent per buyer is up 13 percent and the number of transactions per buyer is also up by 10 percent. Although the total number of buyers has not changed, consumer purchasing power is showing signs of improvement.

To capitalize on the emerging trends outlined by comScore, we have broken down the major takeaways as well as outlined the implications and key opportunities for digital marketers.

eCommerce continues to necessitate resource allocation adjustments

Desktop eCommerce sales are up 12% year-over-year from 2012, setting a potential for $300 billion in overall sales for 2013. With desktop eCommerce outpacing total consumer retail spending, 2013 may be the final call for all marketers to respond by shifting their marketing budgets toward digital strategies. Although users are discovering brands on a multitude of channels, many marketers simply haven’t kept pace or made adjustments for the continuously growing eCommerce trend.

comScore also indicated that shifts to eCommerce stem from new segments of people coming into the market who have graduated, embrace technology, are comfortable with online shopping and now have purchasing power. All digital marketing, from search engine optimization, social media marketing, paid advertising and mobile-optimized websites, will be key moving forward.

For digital advertising, retailers should consider content that calls out their free shipping options. Across segments, retailers are noticing that consumers are driven by free shipping and free returns. This trend will continue to drive online sales.

2013 may be the last opportunity to get a solid foothold on mobile commerce.

Mobile buying now accounts for approximately 11 percent of all ecommerce. And it will only continue to grow. For the first time ever, the majority of internet users now browse on multiple platforms. As of September 2013, approximately 54 percent use both desktop and mobile (smartphone and/or tablet devices) to browse the web and shop online. Marketers must respond with integrated, cross-platform strategies to reach consumers.

In fact, as of August 2013, more digital users engage with brands on their smartphone than on their desktop. The smartphone market saw a 24 percent increase year-over-year to reach 140 million users and tablets had an incredible 60% year-over-year growth to reach 70 million users.

App versus website shopping is still a point of major debate, but depends primarily on the retailer. eBay and Amazon see most shopping and browsing from apps, whereas many other companies are still seeing users gravitate toward mobile browsers. It is, however, still critically important for all eCommerce sites to drive app usage and incentivize downloads. As mobile continues to take over the majority of browsing, it will be critically important to have a foothold in the channel shift. Those that do not risk losing market share.

comScore anticipates that during the 2013 holiday season, mobile commerce will reach its highest percentage of total digital commerce at approximately 12 percent and approach nearly $10 billion in total spending.

It’s time to take advantage of Pinterest and the power of social commerce.

Pinterest is one of the fastest growing websites of all time; its content is image-based collections of primarily retail-centric commodities, making it an excellent social platform for marketers to drive eCommerce sales. Beyond its huge opportunity for marketers overall, Pinterest now has more mobile users than desktop users, yet another consideration for digital marketers moving forward.

Beyond Pinterest, Facebook will continue to help drive online sales. Beyond likes and fan acquisition it will be important for marketers to follow the steps to optimize their social presence and drive Facebook engagement into sales. Brands must reach users in their news feeds with excellent content that their fans then engage with and share to their networks. Quality content when combined with strategic ad placement can help boost conversions and directly influence sales growth.

Conclusion

In order to keep up with emerging trends in eCommerce, mobile purchasing, and social media, marketers must make budget and resource allocation adjustments. As the state of the U.S. economy continues to improve, these changes will be critical for the 2013 holiday shopping season and beyond.

Posted by Zog Digital

CALENDAR

CATEGORIES

TAGS

TWITTER POSTS

CALENDAR

- powered by

- One Big Broadcast

- creative by

- WebStager

© 2024 One Big Broadcast | All rights reserved